Introduction

Wind energy is the oldest and technologically most established renewable source of energy. While land-based wind farms are widespread, the market for offshore wind farms has seen a rise attributable to the stronger and more stable wind resource at sea, and the size of the current generation turbines that inhibit land-based transportation, causing concerns of visual and audible nuisance. To ensure continued development at current sites and to open up new markets, evolution of technologies for installation in deeper waters has become necessary.

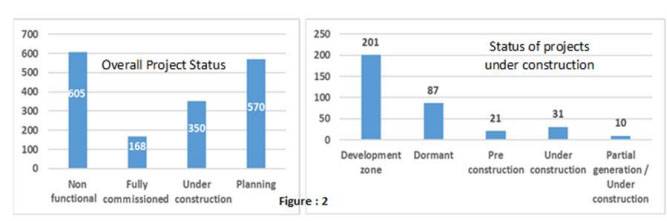

Bottom-fixed foundations inherently have some limited feasibility with increase in depth of water, resulting in the emergence of floating foundations. With more than 30 concepts under development worldwide, Europe is the leader in technology development, working on about two thirds of concepts, closely followed by Japan and the United States. France seems to be particularly interested in semi-submersibles, while Japan and Norway show specific interest in spar buoys. Tension Leg Platform (TLP) designs have mainly originated in the United States.

The offshore industry relies heavily on conventional seabed-fixed foundations, which are believed to be optimal for shallow waters. In fact, a notable 97% of the installed capacity in Europe is supported by monopiles. But in many cases, fixed foundations are simply not an option. A number of countries, including Europe and many others, have a very limited access to shallow waters. Floating foundations can overcome this barrier, allowing developments to move further away offshore. The opportunity is huge as around 80% of Europe’s offshore wind resources are in waters over 60m deep.

Floating foundations offer several opportunities among renewable sources of energy:

- Utilization of deep-water sites

- Access to large areas with a strong wind resource

- Large-scale power generation source for countries with a narrow continental shelf and enough coastal line

- Mid-depth conditions (30-50 meters) offer a lower-cost alternative to fixed-bottom foundations

- Less environmental impact compared to other power-generation means, including fixed foundation offshore wind farms